Every year, hundreds of new food and beverage brands launch with promises of cleaner ingredients, smarter formulations, and better-for-you options. Most disappear within a few years. Some become the products you suddenly see at Target, Costco, and your local grocery store.

The pattern is predictable: brands launch direct-to-consumer or in limited markets, build buzz through trade shows like Natural Products Expo West, attract investment, and then expand nationally. Olipop, RXBAR, and Siete all followed this trajectory. The products that debuted in 2025 are now positioned to hit mainstream retail in 2026.

2025 was an interesting year for natural products launches. The funding landscape shifted, with fewer venture capitalists writing early-stage checks and those who do demanding more equity. But founders adapted. As Erin Barrett, who launched canned cocktail brand Goldilocks, puts it: “It’s the era of founder-led storytelling. Consumers want to see the people behind the brand.”

That tracks with what I’ve noticed. The brands gaining traction aren’t just selling products. They’re selling the story of why they created them. A mom who couldn’t find healthy milk her kids would drink. A co-founder of RXBAR who thought candy could be better. An actor who wanted soda that didn’t make him feel terrible.

Here are six brands from 2025 that are worth watching as they expand in 2026. Some you might see at your grocery store soon. Others are already there.

Key Takeaways

- These 2025 launches are positioned for national retail expansion in 2026

- Hormbles Chormbles: high-protein, zero-sugar candy bars from RXBAR’s co-founder

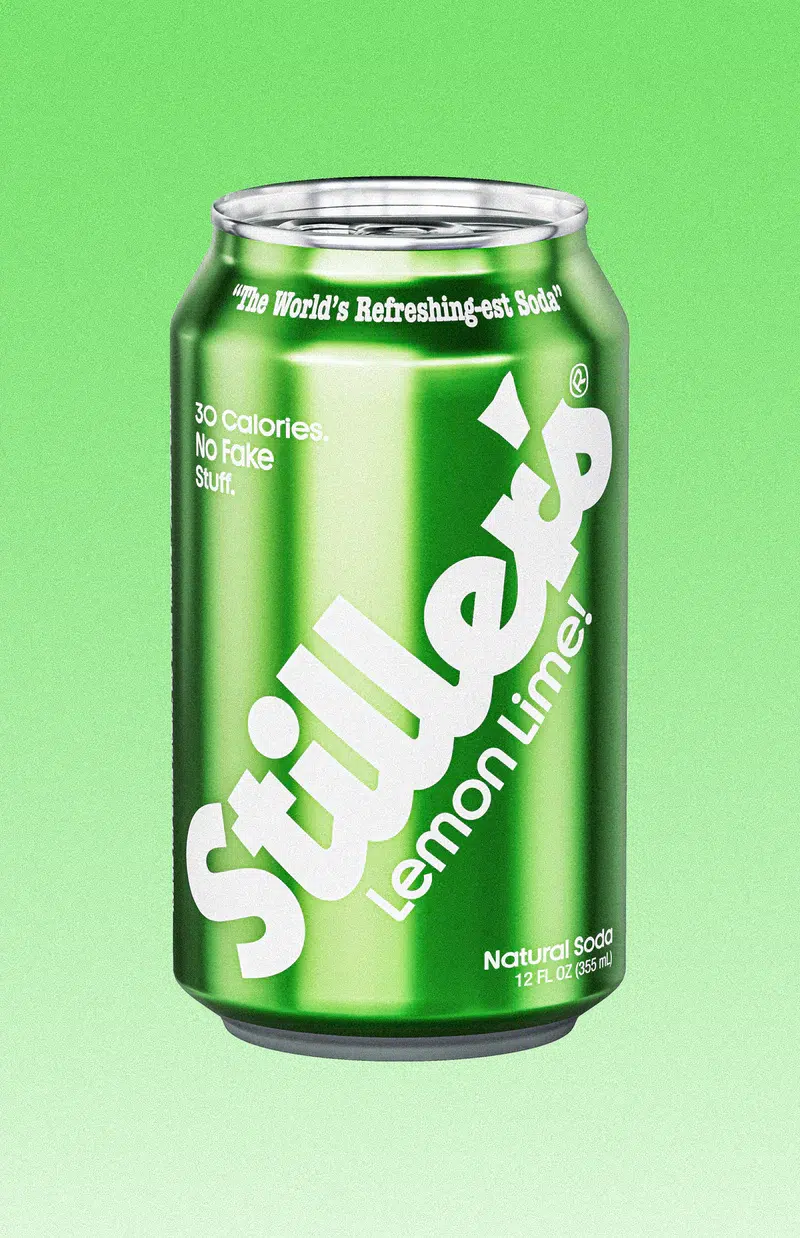

- Stiller’s Soda: Ben Stiller’s vitamin-packed, 30-calorie take on classic flavors

- Chara: protein-rich Greek frozen yogurt with probiotics and no refined sugar

- Goldilocks: better-for-you canned cocktails with prebiotics and real spirits

- Jubilee’s: kids’ milk with hidden vegetables and zero added sugar

- Do’Mo: functional elixirs for socializing without alcohol

- Watch for these brands at Expo West 2026 (March 3-6 in Anaheim)

The Brands

Hormbles Chormbles

Category: Candy / Protein Snacks | Founder: Jared Smith (RXBAR co-founder)

When the co-founder of RXBAR decides candy bars need reinventing, you pay attention. Jared Smith launched Hormbles Chormbles in April 2025 with a simple premise: candy that “makes sense.” Each bar has 10g of protein, 0g of sugar, and 100 calories.

The bars use whey and milk protein, meaning they contain all essential amino acids. Flavors include Salted Fudge, Classic Milk, Cookies-and-Creme, and Peanut Butter.

In October 2025, the brand reformulated to remove EPG (a fat substitute), resulting in slightly higher calories but a cleaner ingredient list. It’s the kind of transparency that built trust for RXBAR, and Smith seems to be applying the same playbook here.

Where to find it: hormbles.com

Stiller’s Soda

Category: Better-for-You Soda | Founder: Ben Stiller

Yes, that Ben Stiller. The actor launched Stiller’s Soda in September 2025, joining the better-for-you soda trend that Olipop and Poppi have made mainstream.

What makes it different? Stiller’s doesn’t have prebiotics. It’s positioned as a cleaner version of classic soda that “actually tastes like soda.” Each can has 30 calories and 7g of sugar, sweetened with a blend of agave, organic stevia, and monk fruit. It’s also fortified with vitamins B12, C, and D.

Launch flavors include Root Beer, Lemon Lime, and Shirley Temple. Available in NYC retailers and on Amazon, with Walmart e-commerce and national retail expansion planned.

Where to find it: Amazon, select NYC retailers, https://stillerssoda.com/

Chara Frozen Yogurt

Category: Frozen Dessert | Founder: Ashley Whalen

Chara makes Greek frozen yogurt with real ingredients, probiotics, and no refined sugar. It’s high protein, lower calorie, and designed to be an actual healthy frozen treat rather than a compromise.

Founder Ashley Whalen has been building the brand in Los Angeles, starting with pop-ups and working toward retail expansion. The company made its trade show debut at Newtopia Now 2025 in Denver.

Whalen’s take on competing in today’s market: “Big brands can’t just buy their way to the top anymore, which levels the playing field. If you tell a great story and build genuine connections, you can compete without a massive marketing budget.”

Where to find it: charafroyo.com, Los Angeles area

Goldilocks

Category: Canned Cocktails | Founder: Erin Barrett

Goldilocks started as a Stanford MBA class project when Erin Barrett realized the cocktails she loved were loaded with sugar and additives. The result: canned cocktails with real spirits, only 2.8g of sugar, 84 calories, and functional ingredients like inulin and prickly pear for gut health.

Launch flavors include Coffee-Tini and Blackberry Spritz, each at 5% ABV. The positioning targets what Barrett calls “the in-between drinker”: people who still enjoy alcohol but want lighter, more intentional options.

Barrett brings experience from McKinsey and Stanford GSB. She’s been candid about the challenges of raising funding in 2025, noting that many VCs have shifted to later-stage investments while early-stage funders demand outsized equity.

Where to find it: drinkgoldilocks.com, New York area

Jubilee’s

Category: Kids’ Beverages | Founder: Austin-based mom

If you’ve ever fought with a kid about eating vegetables, Jubilee’s is speaking directly to you. These organic, shelf-stable milk boxes hide vegetables (beet juice, carrot juice, turmeric) in dessert-inspired flavors like Strawberry Shortcake, Banana Cream Pie, and Chocolate Chip Cookie.

Each box has 8g of protein, zero added sugar, and up to 100x the vitamins of regular milk. The sweetness comes entirely from fruit and vegetable juice.

The founder, an Austin mom, created the brand after struggling to find something convenient, vitamin-packed, and delicious enough for picky eaters. It’s marketed for school lunchboxes and toddlers on the go.

Where to find it: drinkjubilees.com, Amazon

Do’Mo Functional Elixirs

Category: Non-Alcoholic Beverages | Founder: Philip Gladman

Do’Mo is for people who want the social feeling of a cocktail without the alcohol or the hangover. Founder Philip Gladman calls it “the two drink jolly”: that perfect buzz you feel after two or three drinks, without the consequences.

Each can contains 6,000mg of 17 functional ingredients, including adaptogens for stress relief, nootropics for focus, and botanicals for calm. That’s substantially more than most functional beverages on the market.

The brand is part of the growing non-alcoholic alternatives movement targeting consumers who want to participate in social drinking culture without actual alcohol.

Where to find it: Specialty retailers, https://www.drink-domo.com/

What These Brands Have in Common

Looking at these six launches, a few patterns emerge that signal what’s coming to mainstream grocery in 2026:

Founder credibility matters. Whether it’s an RXBAR co-founder, a Stanford MBA, or a celebrity with genuine interest in the category, buyers want to know who’s behind the brand and why they care. Expect to see more founder-forward marketing as these brands expand.

Functional benefits are table stakes. Protein, probiotics, adaptogens, vitamins. Simply being “natural” isn’t enough anymore. Products need to do something specific. This trend will only intensify in 2026.

Sugar is the enemy. Every brand on this list either eliminates sugar entirely or keeps it dramatically lower than conventional alternatives. The anti-sugar messaging will be everywhere in 2026.

Premium positioning, specific audiences. None of these brands are trying to be everything to everyone. They’re targeting specific use cases: parents packing lunchboxes, people who want cocktails without consequences, snackers who want protein without sacrifice.

Where to See What’s Next

If you want to know what products are coming before they hit mainstream retail, Natural Products Expo West 2026 (March 3-6 in Anaheim) is where many of these brands will showcase their expanded lines and new products. It’s a trade-only event, but industry coverage gives you a preview of what’s coming to stores later in the year.

Many of the brands on this list debuted at Expo West 2025 or the Newtopia Now show in Denver. Following the coverage from these events is one of the best ways to get ahead of grocery trends.

Frequently Asked Questions

What is Hormbles Chormbles?

Hormbles Chormbles is a high-protein, zero-sugar candy bar brand launched in 2025 by Jared Smith, co-founder of RXBAR. Each bar has 10g protein, 0g sugar, and about 100 calories. Flavors include Salted Fudge, Classic Milk, Cookies-and-Creme, and Peanut Butter.

Did Ben Stiller really launch a soda brand?

Yes. Stiller’s Soda launched in September 2025 with three flavors: Root Beer, Lemon Lime, and Shirley Temple. Each can has 30 calories and 7g sugar, sweetened with agave, stevia, and monk fruit, plus added vitamins B12, C, and D.

What makes Goldilocks cocktails different?

Goldilocks canned cocktails contain real spirits at 5% ABV but only 2.8g of sugar and 84 calories per can. They include functional ingredients like inulin and prickly pear for gut health. The brand was founded by Stanford MBA Erin Barrett.

What is Jubilee’s milk?

Jubilee’s makes organic, shelf-stable milk boxes for kids that hide vegetables (beet, carrot, turmeric) in dessert-inspired flavors. Each box has 8g protein, zero added sugar, and up to 100x the vitamins of regular milk.

What are functional elixirs?

Functional elixirs are non-alcoholic beverages formulated with ingredients like adaptogens, nootropics, and botanicals to provide specific benefits like energy, calm, or focus. Brands like Do’Mo target consumers who want the social experience of drinking without alcohol.

Where can I buy these products?

Availability varies. Hormbles Chormbles and Jubilee’s are available on their websites and Amazon. Stiller’s Soda is in NYC retailers and Amazon. Goldilocks is available in New York. Chara is primarily in the Los Angeles area. Most brands ship nationwide through their websites.

What to Expect in 2026

These six brands represent the leading edge of what’s coming to mainstream grocery stores in 2026. The pattern is consistent: launch direct-to-consumer, build buzz at trade shows, secure retail partnerships, expand nationally. If you see these brands at Whole Foods or Sprouts this spring, expect them at Target and Costco by fall.

If something on this list looks promising, buying early (through the brand’s website or Amazon) both supports small businesses and gets you access before products hit mainstream retail with potential price increases.

For more on what’s coming in 2026, check out our guide to Expo West 2026. And for the complete list of emerging brands, see New Hope’s full list of 25 brands from 2025.